Dear friends,

Our industry has been evolving globally over the past decade, meanwhile governments have been introducing new laws and regulations on vaping products ever since.

Recently the Canadian Federal Government has implemented an Excise Tax for products containing vaping substances.

We created a guide below to help you understand this development.

What is excise tax?

On April 7, 2022, the Federal Government introduced an excise duty tax on vaping products. This tax applies to any products containing vaping liquid (e-liquid) with or without Nicotine.

All vaping substances that are sold in Canada are required to have an excise duty stamp as proof of taxes paid.

When does this tax come in to effect?

The official date is January 1, 2023. This means that we will be gradually phasing out our unstamped products for duty paid products prior to this date.

On December 1, 2022 most of the products on vapeloft.com will have the excise tax stamp affixed to them and prices will include the new tax. This is due to suppliers depleting inventory of their non-stamped products.

We will continue to sell unstamped products to all countries except Canada while our supplies last. If we have stock of a specific unstamped product, you will be able to select it as an option on that product’s page.

Please note that there may be stock discrepancies and possible product shortages during this transition period between October 2022, and January, 2023. If your order is affected in any way, our team will reach out to you right away!

How much is the excise tax?

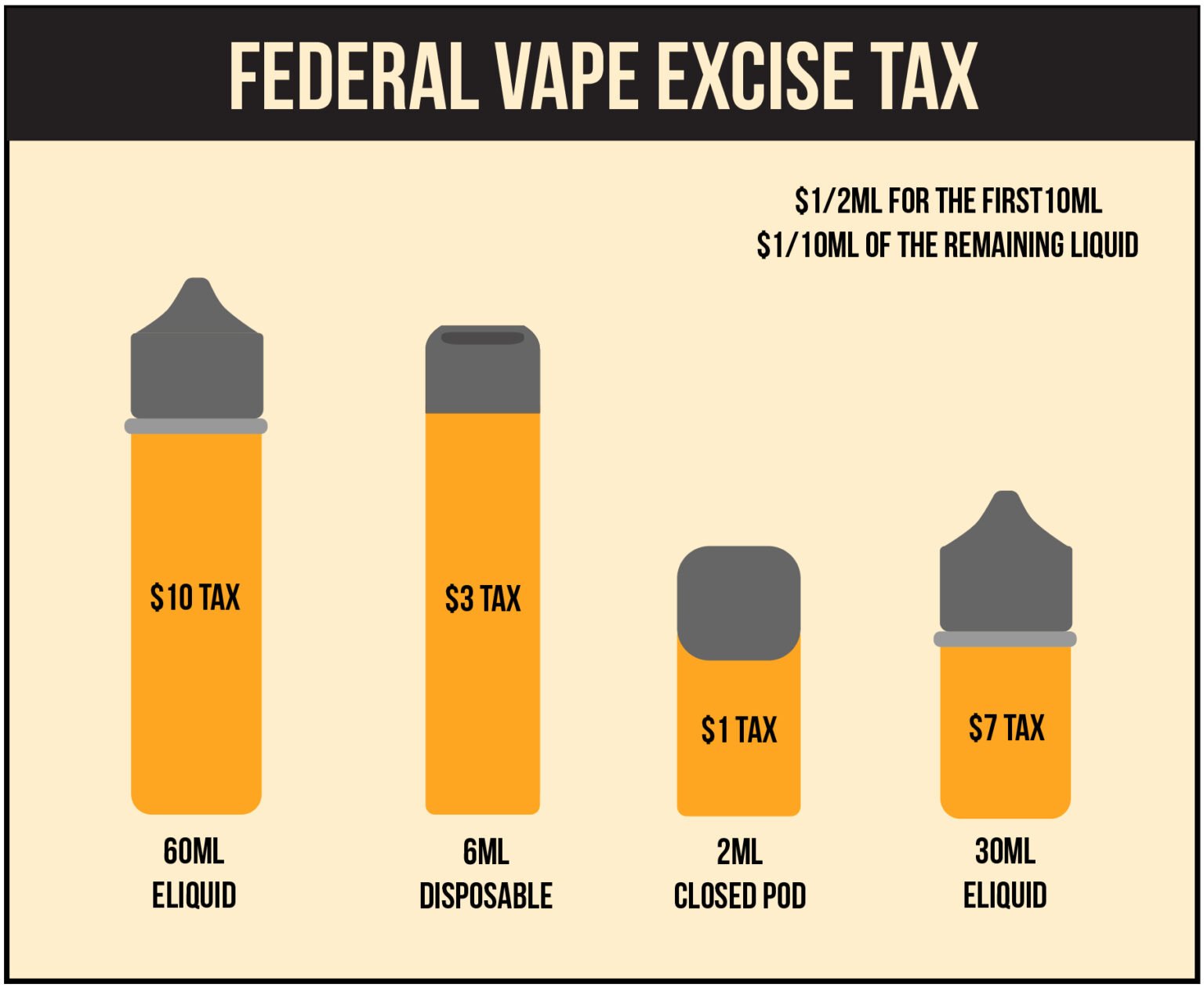

The duty is calculated based on liquid volume of vaping substance in a single container (mL).

- For the first 10mL of liquid, the duty is $1.00 per 2mL.

- For each additional 10mL of liquid, the duty is at the rate of $1.00 per 10mL.

What products are affected?

Any vaping products that contain liquid are subject to the excise tax.

- E-Liquid

- Pre-Filled Pods (STLTH Pods, ALLO Pods, Z-Pods etc.)

- Disposable Vapes

| Bottle Size | Excise Tax per bottle |

|---|---|

| 30mL Bottle | +$7 |

| 60mL Bottle | +$10 |

| 100mL Bottle | +$14 |

Since this Excise tax is collected at manufacturing level by the Canadian Government, we decided to display this tax up front on the product page as opposed to hiding it and surprising you at checkout.